Topics in this Section: About the Department of Health and Human Services | Performance Goals, Objective, and Results | Looking Ahead to 2018 | Systems, Legal Compliance, and Internal Control | Management Assurances | Financial Summary and Highlights

ABOUT THE DEPARTMENT OF HEALTH AND HUMAN SERVICES

Our Mission

The mission of the United States (U.S.) Department of Health and Human Services (HHS or the Department) is to enhance the health and well-being of Americans, by providing for effective health and human services and by fostering sound, sustained advances in the sciences, underlying medicine, public health, and social services.

Our Vision

The vision of HHS is to provide the building blocks that Americans need to live healthy, successful lives.

Who We Are

Did you know?

HHS got its start on April 11, 1953, as the Department of Health, Education and Welfare under President Dwight D. Eisenhower.

HHS is the U.S. government’s principal agency for protecting the health of all Americans, providing essential human services, and promoting economic and social well-being for individuals, families, and communities, including seniors and individuals with disabilities. HHS is responsible for more than a quarter of all federal outlays and administers more grant dollars than all other federal agencies combined. HHS’s Medicare program is the nation’s largest health insurer, handling more than one billion claims per year. Medicare and Medicaid together provide health care insurance for 1 in 3 Americans.

What We Do

HHS works closely with state, local, and tribal governments; and many HHS-funded services are provided at the local level by state or county agencies, private sector grantees, tribes, tribal organizations, or Urban Indian organizations. The HHS Office of the Secretary and its 11Operating Divisions (OpDivs) administer more than 300 programs covering a wide spectrum of activities. In addition to the services they deliver, HHS programs provide for equitable treatment of beneficiaries nationwide and enable the collection of national health and other data. HHS, through its programs and partnerships:

- Provides health care coverage to more than 100 million people through Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP);

- Promotes patient safety and health care quality in health care settings and by health care providers, by assuring the safety, effectiveness, quality, and security of foods, drugs, vaccines, and medical devices;

- Conducts health and social science research with the largest source of funding for medical research in the world, while creating hundreds of thousands of high-quality jobs for scientists in universities and research institutions in every state across America and around the globe;

- Leverages health information technology to improve the quality of care and to use HHS data to drive innovative solutions to health, public health, and human services challenges;

- Improves maternal and infant health; promotes the safety, well-being, and healthy development of children and youth; and supports young people’s successful transition to adulthood;

- Supports wellness efforts across the life span, from protecting mental health, to preventing risky behaviors such as tobacco use and substance abuse, to promoting better nutrition and physical activity;

- Prevents and manages the impacts of infectious diseases and chronic diseases and conditions, including the top causes of disease, disability, and death;

- Prepares Americans for, protects Americans from, and provides comprehensive responses to health, safety, and security threats, both foreign and domestic, whether natural or man-made; and

- Serves as responsible stewards of the public’s investments.

Did you know?

The Substance Abuse and Mental Health Services Administration’s Disaster Distress Helpline is available to provide immediate crisis counseling for people experiencing emotional distress related to the California wildfires, the hurricanes impacting the Gulf Coast and Puerto Rico, or other disasters and traumatic events. Residents can call 800-985-5990 to speak with a trained crisis counselor, or to get help connecting with local behavioral health professionals.

Organizational Structure

HHS’s organizational structure is designed to accomplish its mission and provide a framework for sound business operations and management controls. The Office of the Secretary, with the Secretary, provides the overarching vision and strategic direction for the Department, and leads HHS and its 11 OpDivs to provide a wide range of services and benefits to the American people. The HHS organizational chart, which consists of the Office of the Secretary and the noted StaffDivs and OpDivs, is available at HHS/About HHS/Organizational Chart.

Each OpDiv contributes to our mission and vision as follows:

Administration for Children and Families (ACF) is responsible for federal programs that promote the economic and social well-being of families, children, individuals, and communities. ACF programs aim to empower families and individuals to increase their economic independence and productivity, and encourage strong, healthy, supportive communities that have a positive impact on quality of life and the development of children. Visit ACF for more information.

Administration for Community Living (ACL) was created around the fundamental principle that all people, regardless of age or disability, should be able to live independently, and fully participate in their communities. By advocating for older adults and people with disabilities, and the families and caregivers of both across the federal government; funding services and support provided by networks of community-based organizations; and investing in research and innovation, ACL helps make this principle a reality for millions of Americans. Visit ACL for more information.

Agency for Healthcare Research and Quality (AHRQ) produces evidence to make health care safer, higher quality, more accessible, equitable, and affordable, and to work within HHS and with other partners to make sure that the evidence is understood and used. This mission is supported by focusing on (1) improving health care quality, (2)making health care safer, (3)increasing accessibility, and (4) improving health care affordability, efficiency, and cost transparency. Visit AHRQ for more information.

Agency for Toxic Substances and Disease Registry (ATSDR) is charged with the prevention of exposure to toxic substances and the prevention of the adverse health effects and diminished quality of life associated with exposure to hazardous substances from waste sites, unplanned releases, and other sources of pollution present in the environment. Visit ATSDR for more information.

Centers for Disease Control and Prevention (CDC) collaborates to create the expertise, information, and tools that people and communities need to protect their health through health promotion, prevention of disease, injury and disability, and preparedness for new health threats. CDCworksto protect America from health, safety, and security threats, both foreign and domestic. Whether diseases start at home or abroad, are chronic or acute, curable or preventable, human error or deliberate attack, CDC fights diseases and supports communities and citizens to do the same. Visit CDC for more information.

Centers for Medicare & Medicaid Services (CMS) administers Medicare, Medicaid, CHIP, and the Health Insurance Exchanges, which together provide health care coverage for more than 100 million people. CMS acts as a catalyst for enormous changes in the availability and quality of health care for all Americans. In addition to these programs, CMS has the responsibility to ensure effective, up-to-date health care coverage, and to promote quality care for beneficiaries. Visit CMS for more information.

Food and Drug Administration (FDA) is responsible for protecting the public health by assuring the safety, efficacy, and security of human and veterinary drugs, biological products, medical devices, our nation’s food supply, cosmetics, and products that emit radiation. FDA is also responsible for advancing the public health by helping to speed innovations that make medicines more effective, safer, and more affordable and by helping the public get the accurate, science-based information it needs to use medicines and foods to maintain and improve their health. FDA also has responsibility for regulating the manufacturing, marketing, and distribution of tobacco products to protect the public health and to reduce tobacco use by minors. Finally, FDA plays a significant role in the nation’s counterterrorism capability. FDA fulfills this responsibility by ensuring the security of the food supply and by fostering development of medical products to respond to deliberate and naturally emerging public health threats. Visit FDA for more information.

Health Resources and Services Administration (HRSA) is responsible for improving access to health care by strengthening the health care workforce, building healthy communities, and achieving health equity. HRSA’s programs provide health care to people who are geographically isolated, and economically or medically vulnerable. Visit HRSA for more information.

Indian Health Service (IHS) is responsible for providing federal health services to American Indians and Alaska Natives. The provision of health services to members of federally recognized tribes grew out of the special government-to-government relationship between the federal government and Indian tribes. IHS is the principal federal health care provider and health advocate for the Indian people, with the goal of raising Indian health status to the highest possible level. IHS provides a comprehensive health service delivery system for approximately 2.2million American Indians and Alaska Natives who belong to 567 federally recognized tribes in 36 states. Visit IHS for more information.

National Institutes of Health (NIH) seeks fundamental knowledge about the nature and behavior of living systems and the application of that knowledge to enhance health, lengthen life, and reduce illness and disability. Visit NIH for more information.

Substance Abuse and Mental Health Services Administration (SAMHSA) is responsible for reducing the impact of substance abuse and mental illness on America’s communities. SAMHSA accomplishes its mission by providing leadership, developing service capacity, communicating with the public, setting standards, and improving behavioral health practice in communities, in both primary and specialty care settings. Visit SAMHSA for more information.

In addition, the following Staff Divisions (StaffDivs) report directly to the Secretary, managing programs and supporting the OpDivs in carrying out the Department’s mission. The primary goal of the Department’s StaffDivs is to provide leadership, direction, and policy and management guidance to the Department. The StaffDivs are:

- Immediate Office of the Secretary (IOS). IOS oversees the Secretary’s operations and coordinates the Secretary’s work.

- The Executive Secretariat (ES). ES manages the Department’s policy review and decision-making processes, coordinating the development, clearance, and submission of all policy documents for the Secretary’s review and approval.

- Office of Health Reform (OHR). OHR helps guide and oversee the implementation of the health care legislation and policy.

- Office of Intergovernmental and External Affairs (IEA). IEA represents both the government and external perspective in federal policymaking and clarifies the federal perspective to government officials and external parties.

- Office of the Chief Technology Officer (CTO). CTO harnesses the power of data, technology, and innovation to create a more modern and effective government that works to improve the health of the nation.

- Office of the Assistant Secretary for Administration (ASA). ASA provides leadership for HHS departmental management, including human resource policy and departmental operations.

- Program Support Center (PSC). PSC is a shared services organization dedicated to providing support services to help its customers achieve mission-critical results.

- Office of the Assistant Secretary for Financial Resources (ASFR). ASFR provides advice and guidance to the Secretary on budget, financial management, acquisition policy and support, grants management, and small business programs. It also directs and coordinates these activities throughout the Department.

- Office of the Assistant Secretary for Health (OASH). OASH advises on the nation's public health and oversees HHS's U.S. Public Health Service for the Secretary.

- Office of the Assistant Secretary for Legislation (ASL). ASL provides advice on legislation and facilitates communication between the Department and Congress.

- Office of the Assistant Secretary for Planning and Evaluation (ASPE). ASPE advises on policy development and contributes to policy coordination, legislation development, strategic planning, policy research, evaluation, and economic analysis.

- Office of the Assistant Secretary for Preparedness and Response (ASPR). ASPR advises on matters related to bioterrorism and other public health emergencies.

- Office of the Assistant Secretary for Public Affairs (ASPA). ASPA provides centralized leadership and guidance on public affairs for HHS's StaffDivs, OpDivs, and regional offices. ASPA also administers the Freedom of Information and Privacy Act.

- Office for Civil Rights (OCR). OCR enforces federal laws that prohibit discrimination by health care and human services providers that receive funds from HHS.

- Departmental Appeals Board (DAB). DAB provides impartial review of disputed legal decisions involving HHS.

- Office of the General Counsel (OGC). OGC provides quality representation and legal advice on a wide range of highly visible national issues.

- Office of Global Affairs (OGA). OGA provides leadership and expertise in global health diplomacy and policy to protect the health and well-being of Americans.

- Office of Inspector General (OIG). OIG protects the integrity of HHS programs as well as the health and welfare of the program participants.

- Office of Medicare Hearings and Appeals (OMHA). OMHA administers nationwide hearings for the Medicare program.

- Office of the National Coordinator for Health Information Technology (ONC). ONC provides counsel for the development and implementation of a national health information technology framework.

For more information regarding our organization, components, and programs, visit our website.

PERFORMANCE GOALS, OBJECTIVES, AND RESULTS

Overview of Strategic and Agency Priority Goals

Every 4 years, at the beginning of an Administration’s new term, federal agencies update their strategic plans. Strategic plans present an organization’s mission, vision, and the long-term objectives an agency hopes to accomplish, actions the agency will take in coordinating resources to realize those goals, and how the agency will address challenges or risks that hinder progress. An agency strategic plan is 1 of 3 main elements required by the Government Performance and Results Act of 1993 (GPRA) and the GPRA Modernization Act of 2010.

HHS’s strategic plan defines its mission, goals, and the means by which the Department will measure its progress in addressing specific national problems over a 4-year period. It also describes its work to address complex, multifaceted, and evolving health and human services issues. Each of the Department’s OpDivs and StaffDivs contribute to the development of the strategic plan, as reflected in strategic goals, associated objectives, and strategies within each objective for accomplishing the strategic goals. Refer to the Federal Performance Management Cycle graphic below for details on the strategic plan process.

Strategic Goals

We are currently in the process of updating the HHS Strategic Plan Fiscal Year (FY) 2018 – 2022 (Plan). Under the GPRA Modernization Act, federal agencies are required to consult with Congress and to solicit and consider the views of external parties before updating their strategic plan. HHS is updating its Plan to reflect input received from the public and Congressional consultation that was conducted in the fall of 2017. The final Plan is expected to be published in February 2018, concurrent with the release of the FY 2019 President’s Budget.

While the details of the Plan are still being refined, it will help guide the Department in fulfilling its mission. The mission of HHS is to enhance the health and well-being of Americans, by providing for effective health and human services and by fostering sound, sustained advances in the sciences underlying medicine, public health, and social services. The Department accomplishes its mission by making strategic investments to protect the health and well-being of Americans; delivering hope and healing to the American people; promoting patient-centered care; strengthening services to tribes; investing in the health of America’s future; and ensuring responsible stewardship of taxpayer dollars for long-term sustainability. Achieving these goals will require HHS to make strategic investments and carry out our mission in the most effective manner possible. For more information about our strategic plans and investments, please visit the HHS Budget & Performance page.

Agency Priority Goals

Using the strategic goals and objectives established in the Plan, HHS begins its annual process to set and monitor performance goals and Agency Priority Goals (APGs). HHS uses APGs to improve performance and accountability, and develops APGs by collaborating across the Department to identify activities that reflect HHS priorities and activities benefiting from the focus of the APG process. These goals are ambitious but realistic performance objectives that the Department will strive to achieve within a 24-month period. The Department is currently in the process of developing APGs in support of the Plan. These new APGs will use the knowledge gained through collaboration and data-driven reviews of past processes to deliver results to the public. For more information on HHS’s FY 2018 – 2019 APGs, please visit Performance.gov. Please note that Performance.gov is currently being revised as agencies update goals and objectives for release in February 2018 with the FY 2019 President’s Budget submission to Congress. Please check periodically for updates. HHS performance initiatives, including APGs, continue to influence plans and policies that guide our future efforts.

Performance Management

HHS continues to engage with individuals across the federal performance management community to implement best practices and refine processes. These refinements and lessons learned have also influenced future plans and priorities. HHS actively monitors APG progress and works toward achieving our APGs through quarterly data-driven reviews and other mechanisms. Agencies are required to report quarterly APG progress updates on Performance.gov, and summarize the full year’s past performance results in annual performance reports.

Performance Results

The performance results in this section represent a small sample of key HHS measures across the Department. For some of these measures, a data lag exists and some results are not yet known. This is reflected with “Pending” in the status field of the related measure. For more information on HHS performance measures across the Department, please refer to the HHS Budget & Performance page, expected to be updated in February 2018 concurrent with the FY 2019 President’s Budget.

Serious Mental Illness. Individuals with serious mental illness are a high-need, high-cost population. They frequently use emergency departments and have high readmission rates to inpatient care, especially when co-occurring substance use disorders are present. In addition, people with serious mental illness often have co-morbid physical health conditions and shorter life expectancies than people without serious mental illness, primarily due to co-occurring physical health conditions that too often go unaddressed. Individuals with serious mental illness often experience barriers to treatment, including difficulty accessing and initiating treatment. Significant delays in the identification and treatment of serious mental illness are common; for example, research has repeatedly found that individuals with psychosis in the U.S. often do not receive appropriate treatment for that condition for 1 to 3 years. HHS’s Serious Mental Illness Initiative builds on activities that are currently underway in various HHS agencies; these activities are coordinated through the HHS Behavioral Health Coordinating Council.

Increase access to early intervention services by increasing the number of states with early intervention programs

Unit of Measurement: States

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | N/A | 13 states | 30 states | ||

| Result | 13 states | 25 states | Sept 30, 2017 | ||

| Status | Historical Actual | Target Exceeded | Pending* |

*Data results were not available at the time of publication.

Opioid Morbidity and Mortality. Opioid abuse and overdose present a nationwide public health challenge. Death by drug overdose is the leading cause of injury death in the U.S., with deaths from opioids in particular increasing precipitously in the twenty-first century. Estimates for 2016 indicate that over 64,000 people in the U.S. died of a drug overdose, with the majority of these deaths involving opioids. Overdose deaths involving heroin have increased significantly in recent years, jumping by a factor of five between 2010 – 2016, while the surge of fentanyl use has been the main driver in increasing synthetic opioid deaths. Agencies across HHS recognize the urgency of halting the rise of opioid use disorder and overdose, and are working to develop and implement the most effective interventions, from prevention through treatment, including making sure first responders are equipped with naloxone to use in emergencies. It should be noted that the historical results for the opioid performance measures were recalculated since originally reported. In previous years the entries reflected quarterly data rather than annual results. The reported results now reflect annual figures.

Decrease the total morphine milligram equivalents (MMEs) dispensed

Unit of Measurement: MMEs

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | N/A | N/A | N/A | N/A | 201,741,825,837 |

| Result | 245,476,926,576 | 237,556,023,763 | 224,157,584,265 | 214,000,950,917 | Nov 30, 2017 |

| Status | Historical Actual | Historical Actual | Historical Actual | Historical Actual | Pending |

Increase the number of prescriptions dispensed for naloxone

Unit of Measurement: Prescriptions

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | N/A | N/A | N/A | 4,771 | 5,104 |

| Result | 1,585 | 6,575 | 26,223 | 99,407 | Nov 30, 2017 |

| Status | Historical Actual | Historical Actual | Historical Actual | Historical Actual | Pending |

The FY 2017 APG target for the number of dispensed naloxone prescriptions is much lower (5,104) than the FY2016 actual result (99,407). The FY 2017 goal was based on lower historical actuals from earlier years. Future goals will likely be significantly higher based on more recent higher historical actuals.

Increase the number of unique patients receiving prescriptions for buprenorphine (BUP) and naltrexone (NAL) in a retail setting

Unit of Measurement: Patients

| FY 2013 | FY 2014 (BUP) | FY 2014 (NAL) | FY 2015 (BUP) | FY 2015 (NAL) | FY 2016(BUP) | FY 2016(NAL) | FY 2017(BUP) | FY 2017(NAL) | |

|---|---|---|---|---|---|---|---|---|---|

| Target | N/A | N/A | N/A | N/A | 915,207 | 112,398 | 958,788 | 117,750 | |

| Result | 834,352 | 141,110 | 921,329 | 197,410 | 982,488 | 254,654 | Nov 30, 2017 | Nov 30, 2017 | |

| Status | Historical Actual | Historical Actual | Historical Actual | Historical Actual | Historical Actual | Historical Actual | Pending | Pending |

International Field Epidemiology Training Programs (FETPs). Since 1980, CDC has developed FETPs that have graduated over 3,700 epidemiologists in over 70 countries. Through FETPs, CDC helps establish a network of disease detectives around the globe to serve as the first line of defense in detecting and responding to outbreaks in their respective regions as well as neighboring countries. In FY2016, there were 470new residents of the FETP program, exceeding CDC’s target for new residents by 40. On average, over 80 percent of FETP graduates work within their Ministry of Health after graduation and many assume key leadership positions, such as the National Director of Tuberculosis program and National Director of Chronic Disease program in the Dominican Republic. Their presence strengthens global health ministries’ ability to detect and respond to outbreaks and enhances sustainable public health capacity in these countries, which is critical in transitioning U.S.-led global health investments to long-term host-country ownership. FETP activities are supported by funding from CDC appropriations and inter-agency agreements with the Department of Defense, Department of State, and the U.S. Agency for International Development.

Increase epidemiology and laboratory capacity within global health ministries through the FETP New Residents

Unit of Measurement: New Residents

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | 255 | 430 | 430 | 430 | 430 |

| Result | 300 | 402 | 483 | 470 | June 30, 2018 |

| Status | Target Exceeded | Target Not Met but Improved | Target Exceeded | Target Exceeded | Pending |

Reduction in Head Start Grantees Receiving a Low Score on the Classroom Assessment Scoring System (CLASS:Pre-K). ACF is striving to increase the percentage of Head Start children in high quality classrooms. CLASS:Pre-K is a research-based tool that measures, on a seven-point scale, teacher-child interaction in three broad domains: (1) Emotional Support, (2) Classroom Organization, and (3) Instructional Support. Progress is measured by reducing the proportion of Head Start grantees that score in the “low” range on any of the three domains. An analysis of CLASS scores for FY 2016 indicates that 24 percent of grantees scored in the “low” range, exceeding the target of 25 percent. All “low” range scores were in the Instructional Support domain.

ACF continues to invest in expanding its CLASS related resources and making those resources available to grantees. ACF provides more intentional targeted assistance to those grantees that score in the “low” range on CLASS. ACF continues to conduct more analysis on the specific dimensions that are particularly challenging for those grantees, such as concept development and language modeling, and tailor the technical assistance for grantees based on their specific needs.

Recent data analysis from the Family and Child Experience Survey (FACES), a federally funded nationally representative survey of Head Start programs, provides some evidence that grantee scores on CLASS domains have improved over time. This analysis demonstrates that over time fewer classrooms scored in the “low” range and more classrooms scored in the “mid” to “high” range on Instructional Support. FACES data also shows a statistically significant increase in the average score and the percentage of Head Start classrooms scoring three or higher on Instructional Support between 2006 and 2014. Overall, Head Start classrooms regularly score above a five(on a scale of one to seven) in Emotional Support and Classroom Organization. The FACES data analysis showed that over time fewer classrooms scored in the “mid” range and more classrooms scored in the “high” range on Emotional Support. FACES data also includes another measure of classroom quality using the Early Childhood Environment Rating Scale where items are rated on a seven-point scale, ranging from inadequate to excellent. There was a statistically significant increase of classrooms moving into the “good” and “excellent” category on the Teaching and Environments and Provisions to Learning items from 2006 to 2014. For example, the percent of classrooms in the “good” and “excellent” category in Teaching and Environments item moved from 13 percent in 2006 to 54 percent in 2014.

Reduce the proportion of Head Start grantees receiving a score in the low range on the basis of CLASS: Pre-K

Unit of Measurement: Percent

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | 23% | 27% | 26% | 25% | 24% |

| Result | 31% | 23% | 22% | 24% | Jan 31, 2018 |

| Status | Target Not Met | Target Exceeded | Target Exceeded | Target Exceeded | Pending |

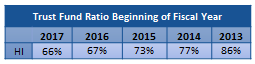

Medicare Fee-For-Service (FFS), Medicaid, and CHIP Improper Payment Rates. One of HHS’s key goals isto pay Medicare, Medicaid, and CHIP claims properly the first time. This means paying the right amount, to legitimate providers, for covered, reasonable, and necessary services provided to eligible beneficiaries. Paying correctly the first time saves resources required to recover improper payments and ensures the proper expenditure of valuable dollars. The decrease from the prior year’s reported Medicare FFS improper payment estimate of 11.00 percent was driven by a reduction in improper payments for home health and Inpatient Rehabilitation Facility (IRF) claims. Although the improper payment rate for these services and the national Medicare FFS improper payment rate decreased, improper payments for home health, Skilled Nursing Facility, and IRF claims were the major contributing factors to the FY 2017 Medicare FFS improper payment rate. While the factors contributing to improper payments are complex and vary from year to year, the primary causes of improper payments continue to be insufficient documentation and medical necessity errors. HHS uses data from the Comprehensive Error Rate Testing program and other sources of information to address improper payments in Medicare FFS through various corrective actions, such as policy clarifications and simplifications, when appropriate, as well as Probe and Educate reviews, which include more individualized education through smaller probe reviews, followed by specific education based on review findings. HHS is also continuing prior authorization initiatives, as appropriate, which help to make sure that applicable coverage, payment, and coding rules are met before services are rendered while ensuring access to care and quality of care.

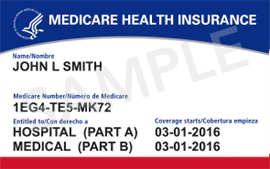

Did you know?

New Medicare cards are coming. The new card contains a unique, randomly-assigned number that replaces the current Social Security-based number. The change will help to prevent fraud, fight identity theft, and protect taxpayer dollars.

Since one-third of the states are measured annually to calculate the Medicaid and CHIP improper payment rates, these measures are calculated as a rolling rate that includes the reporting year and the previous 2 years. Similar to recent years, the driver of each rate was state difficulties complying with provider screening, enrollment, and National Provider Identifier (NPI) requirements. Although the 17 states reviewed this year had better compliance results for Medicaid compared to their previously measured cycle, non-compliance with the provider screening, enrollment, and NPI requirements is still a major contributor to the Medicaid improper payment rate. Additionally, Medicaid improper payments due to no or insufficient medical documentation increased in FY 2017. For CHIP, the 17 states reviewed this year did not have better compliance results. A higher percentage of CHIP providers are not enrolled in Medicare and, therefore, there are more cases where states are not able to rely on provider screening conducted by Medicare and must conduct their own screening. Additionally, there was an increase in managed care improper payments in FY 2017 due to recipients that aged out of CHIP. States are required to develop and submit corrective action plans. HHS is working with states to improve compliance with the requirements and address all errors that contributed to the improper payment rates. Refer to “Section 3, Payment Integrity Report” for further details.

Reduce the Percentage of Improper Payments Made Under the Medicare FFS Program

Unit of Measurement: Percent

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | 8.3% | 9.9% | 12.50% | 11.50% | 10.40% |

| Result | 10.1% | 12.7% | 12.09% | 11.00% | 9.51% |

| Status | Target Not Met | Target Not Met | Target Exceeded | Target Exceeded | Target Exceeded |

Reduce the Improper Payment Rate in the Medicaid Program

Unit of Measure: Percent

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | 6.4% | 5.6% | 6.70% | 11.53% | 9.57% |

| Result | 5.8% | 6.7% | 9.78% | 10.48% | 10.10% |

| Status | Target Exceeded | Target Not Met | Target Not Met | Target Exceeded | Target Not Met |

Reduce the Improper Payment Rate in CHIP

Unit of Measurement: Percent

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | |

|---|---|---|---|---|---|

| Target | 6.50% | 6.81% | 7.38% | ||

| Result | 6.80% | 7.99% | 8.64% | ||

| Status | Target Not Met | Target Not Met | Target Not Met |

LOOKING AHEAD TO 2018

HHS accomplishes its mission through programs and initiatives that cover a wide spectrum of activities. Eleven OpDivs, including eight agencies in the U.S. Public Health Service and three human services agencies, administer HHS’s programs. While HHS is a domestic agency working to protect and promote the health and well-being of the American people, the interconnectedness of our world requires that HHS engage globally to fulfill its mission. In addition, StaffDivs provide leadership, direction, and policy guidance to the Department.

As described in the Performance Goals, Objectives and Results section, concurrent with the FY 2019 President’s Budget submission, HHS will update its Strategic Plan to align with the priorities of this Administration. The Strategic Plan’s goals and related objectives will drive HHS’s service to the American people. Along with a new Strategic Plan, the next President’s Budget submission will also include a new set of APGs. These goals are a set of ambitious but realistic performance objectives that the Department will strive to achieve within a 24-month period. These new APGs will use the knowledge gained through collaboration and data-driven reviews of past processes to deliver results to the public.

While the Patient Protection and Affordable Care Act (PPACA) is established law, health care reform to better serve the American people is expected. HHS remains committed to fostering a high-quality health care system that effectively and efficiently serves our citizens. We aim to facilitate a patient-centered approach that offers ample consumer choice and lower overall costs to stakeholders. Patients, families, and doctors should be in charge of the medical decisions impacting them. HHS will continue to work with states to advance their health-related programs, and to improve the accessibility and affordability of health care. The Message from the Acting Secretary addresses one of the most pressing issues facing the American public—the ongoing opioid crisis. Acting Secretary Hargan took action on October26, 2017, by declaring a nationwide public health emergency. According to the CDC, more than 175 Americans die every day from drug overdoses, with 91 of those deaths occurring specifically from opioids. HHS developed a five-point strategy to combat opioids, which includes the following steps:

- Improve access to prevention, treatment, and recovery support services;

- Target the availability and distribution of overdose-reversing drugs;

- Strengthen public health data and reporting;

- Support cutting-edge research on addiction and pain; and

- Advance the practice of pain management.

The Administration has made combating opioid abuse and fighting addiction an Administration-wide effort and priority, and the Budget submission reflects this commitment. HHS will continue to invest in activities to fight opioid abuse, provide funding for substance abuse treatment, and seek to improve prescribing practices and the use of medication-assisted treatment.

SYSTEMS, LEGAL COMPLIANCE, AND INTERNAL CONTROL

Systems

Financial Systems Environment

HHS’s Chief Financial Officer (CFO) Community strives to enhance and sustain a financial management environment that supports the HHS mission by promoting accountability and managing risk. To support this vision, the HHS financial systems environment forms the financial and accounting foundation for managing the $1.7 trillion in budgetary resources entrusted to the Department in FY 2017. These resources represent more than a quarter of all federal outlays and encompass more grant dollars than all other federal agencies combined.

The robust financial systems environment sustains HHS’s diverse portfolio of mission-oriented programs, as well as business operations. Its purpose is to: efficiently process financial transactions in support of program activities and HHS’s mission; provide complete and accurate financial information for decision-making; improve data integrity; strengthen internal control; and mitigate risk.

The HHS financial systems environment consists of a core financial system (with three instances) and two Department-wide reporting systems used for financial and managerial reporting that together support the Department’s financial accounting and reporting needs.

Core Financial System

HHS’s core financial system’s three instances all operate on the same commercial off-the-shelf (COTS) platform to support data standardization and facilitate Department-wide reporting.

- The Healthcare Integrated General Ledger Accounting System (HIGLAS) supports CMS. HIGLAS serves CMS’s Medicare Administrative Contractor organizations, Administrative Program Accounting, and the Center for Consumer Information and Insurance Oversight. It processes an average of five million transactions daily.

- The NIH Business System (NBS) combines NIH administrative processes and financial information under one centralized component, supporting NIH’s diverse biomedical research program; and business, financial, acquisition and logistics requirements for 27 NIH Institutes and Centers. NBS supports grant funding to more than 300,000 researchers at over 2,500 universities, medical schools, and other research institutions in every state and around the world.

- The Unified Financial Management System (UFMS) serves 10 OpDivs (including the Office of the Secretary) and 14 StaffDivs across the Department. The following accounting centers utilize UFMS: CDC, FDA, IHS, and PSC. PSC provides shared service accounting support for all other Divisions utilizing UFMS.

Reporting Systems

Reporting components within the HHS financial systems environment consist of two Department-wide applications: the Consolidated Financial Reporting System (CFRS) and the Financial Business Intelligence System (FBIS). These reporting systems facilitate data reconciliation, financial and managerial reporting, and data analysis.

- CFRS systematically consolidates information from all three instances of the core financial system. It generates Departmental quarterly and year-end consolidated financial statements on a consistent and timely basis, while supporting HHS in meeting regulatory reporting requirements.

- FBIS is the financial enterprise business intelligence application that supports the information needs of HHS stakeholders at all levels by retrieving, combining, and consolidating data from the core financial

system. It provides tools for analyzing data and presenting actionable information including metrics and key performance indicators, dashboards with graphical displays, interactive reports, and ad-hoc reporting. FBIS enables executives, managers, and operational end users to make informed business decisions to support their organization’s mission.

The figure below graphically depicts the current financial systems environment.

Relevant Legislation and Guidance

The HHS financial systems environment must comply with all relevant federal laws, regulations, and authoritative guidance. In addition, HHS must conform to federal financial management and systems requirements including:

- Federal Managers’ Financial Integrity Act of 1982;

- Chief Financial Officers Act of 1990;

- Government Management Reform Act of 1994;

- Federal Financial Management Improvement Act of 1996;

- Clinger-Cohen Act of 1996;

- Federal Information Security Management Act of 2002, as amended by the Federal Information Security Modernization Act of 2014;

- Digital Accountability and Transparency Act of 2014;

- Federal Information Technology Acquisition Reform Act of 2014;

- Fraud Reduction and Data Analytics Act of 2015; and

- Office of Management and Budget (OMB) directives and U.S. Department of the Treasury (Treasury) guidance related to these laws.

Financial Systems Environment Improvement Strategy

HHS continues to implement a Department-wide strategy to advance its financial systems environment through the Financial Systems Improvement Program (FSIP) and Financial Business Intelligence Program (FBIP). The portfolio of projects within these programs addresses immediate business needs and positions the Department to take advantage of state-of-the-art tools and technology. The goals of the strategy are to improve the effectiveness and efficiency of the Department’s financial management capabilities, mature the overall financial systems environment, and strengthen accountability and financial stewardship. This is a multi-year initiative, and the Department continues to make significant progress in each of the following key strategic areas.

Financial Systems Modernization

- Strategy: As a critical component of the multi-year initiative, the core financial system was upgraded to the most current version of its COTS software to maintain a secure and reliable financial systems environment. Concurrently, HHS also transitioned key financial systems to a cloud service provider for hosting and application management. With those major initiatives completed successfully, HHS is now directing resources towards incrementally improving the efficiency and effectiveness of the upgraded financial system. Taken together, these projects are designed to significantly mature the HHS financial systems environment, offering benefits that include: safeguarding system security and privacy; enhancing information access; complying with and implementing evolving federal requirements; achieving efficiencies and promoting standardization; eliminating security and control vulnerabilities; and maximizing the return on existing system investments.

- Progress: HHS completed the major upgrade of its core financial system in December 2015 and, as part of the upgrade, transitioned three key financial management systems – UFMS, FBIS, and CFRS – to a Federal Risk and Authorization Management Program certified cloud service provider. This year, HIGLAS was successfully migrated to a new, Federal Information Security Management Act High certified operating environment – completing the migration in just 7 months and processing over $2 billion in claims on the first day following go-live. With the financial system stabilized on the upgraded platform, particular focus was given in FY 2017 to strengthening the system security and control environment. This included implementing encryption and compression in key systems to secure data-at-rest, improve performance, and reduce the overall storage footprint; completing a major UFMS security redesign to resolve long-standing control weaknesses; and enabling single sign-on across multiple systems to meet federal requirements and enhance overall security posture. Maturing the financial system infrastructure, applications, and security controls has provided HHS with a strong foundation. Current FSIP projects – such as the recent completion of a business case for a Department-wide electronic invoicing solution – build on this foundation, improving business functionality, and enhancing the effectiveness and efficiency of the Department’s financial management capabilities.

Business Intelligence and Analytics

- Strategy: Leveraging the FBIS platform, HHS is expanding the use of business intelligence and analytics across the Department to establish an information-driven financial management environment in which stakeholders at all levels have access to timely and accurate information required for measuring performance, increasing transparency, and enhancing decision-making. This will allow the Department to more effectively and sustainably meet evolving information demands for fiscal accountability, performance improvement, and external compliance requirements.

- Progress: Since first deployed in FY 2012, FBIS has been providing operational and business intelligence to users across the HHS financial management community. FBIS offers accurate, consistent, near real-time data from UFMS and NBS (together comprising five of HHS’s six accounting centers) and summary data from HIGLAS, supporting over 2,100 users across the Department. Key accomplishments in FY 2017 include: integration of NBS transaction-level data and development of reconciliation dashboards prioritized by the NIH Office of Financial Management, as well as development of new global dashboards and reports that enable more efficient budget execution and tracking/closeout of unliquidated obligations. As FBIS continues to expand to include new users and business domains, HHS is also focused on optimizing the underlying solution architecture to improve performance and take full advantage of the cutting-edge capabilities of the FBIS commercial cloud hosting environment.

Systems Policy, Security, and Controls

- Strategy: The reliability, availability, and security of HHS’s financial systems are of paramount importance. HHS has placed a high-priority on enhancing its financial systems security and controls environment, strengthening policy, proactively monitoring emerging issues, and ensuring progress toward remediating the Department’s information technology (IT) material weakness. HHS has implemented a comprehensive, enterprise-wide financial systems policy, security, and controls program to mature and decrease risk across the environment.

- Progress: HHS addresses the Department’s IT material weakness by analyzing internal and external audit findings, identifying root causes, and implementing solutions collaboratively. Persistent weaknesses are being addressed, with 86 percent of Federal Information System Controls Audit Manual (FISCAM) findings identified prior to FY 2014 not being reissued by the independent auditor. Targeted efforts are continuing to further reduce risk across the financial management systems portfolio, as the annual closure rate of findings in high-risk control areas (access controls, configuration management, and segregation of duties) has increased over 45 percent from FY 2013 to FY2016. Initiatives in FY 2017 have significantly matured the Department-wide security and control environment, with system owners having completed corrective actions for 97 percent of FISCAM weaknesses identified through prior year’s audit. Beyond simply tracking closure of individual weaknesses to assess progress, HHS also developed a comprehensive management framework – including evaluation criteria and target measurements – to better inform HHS leadership and other stakeholders of overall progress made, the current maturity level of the security and control environment, and the associated level of risk. The FY 2017 Assessment highlights HHS’s demonstrated year-over-year progress since FY 2015 in remediating control deficiencies, institutionalizing governance and oversight, and strengthening the IT controls environment – providing management a holistic view of HHS’s security and control posture, as well as aggregated data to substantiate assurances.

To lead and sustain these efforts, the Financial Management Governance Board (FGB) chartered the ITMaterial Weakness Working Group (MWWG), with members from OpDiv CFO, Chief Information Officer (CIO), and Chief Information Security Officer communities. The IT MWWG has met monthly since FY 2015 and is executing against its planned roadmap to address pervasive issues, recommend comprehensive remediation approaches, and monitor implementation progress. Working on two fronts – coordinating responsive efforts to address current audit findings as well as proactive efforts to mature the security and controls environment going forward – HHS is managing a portfolio of projects to address and minimize vulnerabilities and risks related to data and system security, access management, configuration management, and segregation of duties.

Governance

- Strategy: In November 2013, the Department established the FGB as an executive-level forum to address enterprise-wide issues, including those related to financial management policies and procedures, financial data, and technology. The FGB’s goals include establishing HHS financial management governance; providing people, processes, and technology to support governance; engaging stakeholders through effective communication and management strategies; and supporting project alignment with federal and HHS mandates and priorities.

- Progress: The FGB has convened monthly and facilitated executive-level oversight of financial management-related areas. Its role and impact continue to grow since its inception 4 years ago. It promotes collaboration among stakeholders from the different disciplines within the financial management community by engaging senior leadership from HHS OpDivs and StaffDivs and across functions such as finance, budget, grants, human resources, and The FGB has effectively transformed the way in which financial management initiatives and activities are accomplished in HHS, moving from a Division-specific, vertical focus to a more enterprise-wide approach to solving problems and implementing standards for financial management excellence. Beyond improving collaboration and strengthening oversight across HHS’s financial management and systems environment, the FGB serves as an advisory body, providing actionable recommendations to support project teams and guide future initiatives. Recent areas of focus have included risk and change management for the financial systems modernization effort, as well as forward-looking discussions on key topics – for example, shared services and financial transparency – that will inform strategic planning and enable the HHS financial management community to effectively address evolving opportunities and challenges.

Program Management

- Strategy: To support FSIP and FBIP, HHS established a Department-wide program management framework to facilitate effective implementation of projects and to enhance collaboration across project teams. This includes the Financial Systems Consortium: a body of federal project managers, contractors, and federal contracting officers representing NBS, UFMS, and HIGLAS, that fosters communication and implementation of program and project management best practices.

- Progress: Department-wide program management and the Financial Systems Consortium played critical roles in coordinating both the successful upgrade of the HHS core financial system and subsequent financial systems modernization projects. Within this framework, project teams are able to share industry best practices, lessons learned, and risks identified, while minimizing overall costs. This includes sharing solutions across system teams to streamline implementation, as well as coordinating vendor support to resolve software issues. Effective program management has reduced duplication of effort and costs by identifying potential sharing opportunities and improvements. Though developed initially to facilitate the major financial systems upgrade, both the Enterprise Program Management Office and the Financial Systems Consortium continue to exist as forums to support on-going collaboration and coordination across the financial systems environment and modernization initiatives.

Sharing Opportunities

- Strategy: As a key FSIP component, HHS is actively pursuing multiple initiatives to generate efficiencies and improve effectiveness through implementing shared solutions. The Department has also established a framework for continuously identifying sharing opportunities in its financial systems environment.

- Progress: Examples of sharing opportunities pursued to date include transitioning key financial systems to a cloud service provider; the use of shared acquisition contracts and streamlining of system operations and maintenance contracts; the implementation of a Department-wide Accounting Treatment Manual; consolidation of three legacy managerial reporting systems into FBIS; and sharing solutions across the HHS financial community. Currently, the HHS finance, acquisition, and IT communities are collaboratively pursuing a Department-wide solution for electronic invoicing, supporting compliance with OMB direction as well as specific business needs identified across HHS. The FGB continues to assess future sharing opportunities across the enterprise to further align with financial management and system policies, business processes and operations, and the overall financial system vision and architecture.

Legal Compliance

Anti-Deficiency Act

The Anti-Deficiency Act (ADA) prohibits federal employees from obligating in excess of an appropriation, or before funds are available, or from accepting voluntary services. As required by the ADA, HHS notifies all appropriate authorities of any ADA violations. ADA reports can be found on GAO - ADA.

HHS management is taking necessary steps to prevent violations. On August 1, 2016, the Director of OMB approved HHS’s updated Administrative Control of Funds policy, as required by United States Code, Title 31, Money and Finance, Section 1514, “Administrative Division of Apportionments.” This policy provides HHS’s guidelines to follow in budget execution and to specify basic fund control principles and concepts, including the administrative control of all funds for HHS and its OpDivs, StaffDivs, and Accounting Centers. With respect to twopossible issues, we are working through investigations and further assessment where necessary. We remain fully committed to resolving these matters appropriately and complying with all aspects of the law.

Improper Payments Information Act of 2002, Improper Payments Elimination and Recovery Act of 2010, and Improper Payments Elimination and Recovery Improvement Act of 2012

An improper payment occurs when a payment should not have been made, federal funds go to the wrong recipient, the recipient receives an incorrect amount of funds, the recipient uses the funds in an improper manner, or documentation is not available to verify the appropriateness of the payment. TheImproper Payments Information Act of 2002(IPIA), as amended by theImproper Payments Elimination and Recovery Act of 2010(IPERA) and theImproper Payments Elimination and Recovery Improvement Act of 2012(IPERIA), requires federal agencies to review their programs and activities to identify programs that may be susceptible to significant improper payments, test for improper payments in high risk programs, and develop and implement corrective action plans for high risk programs. HHS works to better detect and prevent improper payments through close review of our programs and activities using sound risk models, statistical estimates, and internal controls.

HHS has shown tremendous leadership in the improper payments arena. HHS has a robust improper payments estimation and reporting process that has been in place for many years, and has taken many corrective actions to prevent and reduce improper payments in our programs. In compliance with the IPIA as amended, HHS completed 24 improper payment risk assessments in FY 2017 (representing risk assessments of programs and charge cards), and determined that these programs were not susceptible to significant improper payments. In addition, HHS is publishing improper payment estimates and associated information for nine high risk programs in this year’s AFR, of which six programs reported lower improper payment rates in FY 2017 compared to FY 2016. Lastly, HHS also utilizes the Do Not Pay portal to check payments and awardees to identify potential improper payments or ineligible recipients. In FY 2017, HHS screened more than $419 billion in Treasury-disbursed payments through the Do Not Pay portal; HHS identified no improper payments. A detailed report of HHS’s improper payment activities and performance is presented in the “Other Information” section of this AFR, under “Payment Integrity Report.”

Patient Protection and Affordable Care Act

The Patient Protection and Affordable Care Act (PPACA) established Health Insurance Exchanges through which qualified individuals and qualified employers can purchase health insurance coverage. Many individuals who enroll in Qualified Health Plans (QHPs) through individual market Exchanges are eligible to receive a premium tax credit (PTC) to reduce their costs for health insurance premiums. PTCs can be paid in advance directly to the consumer’s QHP insurer. Consumers then claim the PTC on their federal tax returns, reconciling the credit allowed with any advance payments made throughout the tax year. HHS coordinates closely with the Internal Revenue Service on this process.

The PPACA also included provisions that address fraud and abuse in health care by toughening the sentences for perpetrators of fraud, employing enhanced screening procedures, and enhancing the monitoring of providers. These authorities have facilitated the government’s efforts to reduce improper payments. For detailed information on improper payment efforts, see “Section 3, Payment Integrity Report.”

Digital Accountability and Transparency Act of 2014

The Digital Accountability and Transparency Act of 2014 (DATA Act) expands the Federal Funding Accountability and Transparency Act of 2006 (FFATA) to increase accountability and transparency in federal spending, making federal expenditure information more accessible to the public. It directs the federal government to use governmentwide data standards for developing and publishing reports, and to make more information, including award-related data, available on USAspending.gov. Among other goals, the DATA Act aims to improve the quality of the information on USAspending.gov, as verified through regular reviews of posted data, and to streamline and simplify reporting requirements through clear data standards. Additionally, the DATA Act accelerated the referral of delinquent debt owed to the federal government to the Treasury’s Offset Program after 120 days of delinquency.

Since 2014, HHS has played an integral role in the iterative development of data requirements and policy, utilizing internal and governmentwide working groups to analyze and provide feedback to the Treasury. HHS provided feedback on policy guidance through formal OMB policy review periods and by actively participating in various forums such as OMB Office Hours, Senior Accountable Official calls, and DATA Act Tech Thursdays. These forums help shape the evolution of the governmentwide DATA Act implementation and enhance existing FFATA reporting by providing a platform in which federal agencies collaborate and share information. HHS also collaborated extensively within the Interagency Advisory Committee, which represents the federal communities impacted by the DATA Act, to provide substantive community-specific and cross-cutting feedback to OMB and Treasury in support of governmentwide standardization and related policy considerations.

To support the initial DATA Act reporting requirements for May 2017, HHS established solution teams aligned with the Financial Management, Financial Assistance, Acquisition and Budget business lines that are operationally responsible for generating and validating submissions to ensure transparency, consistency, and compliance. HHS also established working groups to target specific challenges such as Award ID linkage, Aggregated Data, and Activity Address Code. The HHS DATA Act Program Management Office (DAP) continued work with these solution teams and working groups to coordinate overall activities and track progress towards completing key HHS milestones. These efforts enabled HHS to compile data consistent with submission requirements and to iteratively test this data using the DATA Act Information Model Schema available on its new USAspending.gov (Beta)[1] to support initial compliance with the DATA Act. Finally, HHS executed the implementation strategy by leveraging existing processes for data validation, error handling, and internal controls in order to effectively identify and address data discrepancies in a timely manner and build the certification process for DATA Act reporting in May2017. This enabled HHS to successfully complete the initial submission and certification in April 2017 for second quarterFY2017 data as well as subsequent reporting in August 2017 for third quarter data.

The DATA Act aims to standardize data and make it more transparent to the public by requiring the federal government to establish governmentwide data standards and publish all appropriate federal spending data so that it is accessible, searchable, and reliable. The information is now available, to the public for searching and extracting spending data across the government. Previously, data had been published over contract and grant awards, now users have access to a broader scope of information that includes funding and financing, program-level spending, and links to supplemental data sources such as vendor data. The new website provides graphics that interactively display funds available, program size, recipient distribution, and much more. For further details on how to explore the data, see USAspending.gov (Beta)1.

Section 5 of the DATA Act calls for a Grants Pilot to help form recommendations to Congress on methods for (1)standardized reporting; (2)elimination of duplication; and (3) reduction of compliance costs. The Grants Pilot was divided into a Grants portion led by HHS and a Contracts portion led by OMB/Office of Federal Procurement Policy. Since May 2015, HHS worked in partnership with OMB, as its executing agent for the Grants Section 5 Pilot, to develop and execute pilot test models that focus on finding ways to promote government efficiency and improve the public’s experience throughout the grants lifecycle. Test Models include the Common Data Element Repository Library, Consolidated Federal Financial Reporting, Single Audit, Notice of Award - Proof of Concept, and Learn Grants. DAP used these existing tools, forms, and/or processes to collaborate with stakeholders in ascertaining where grant recipient burden could be reduced.

HHS engaged the public in this area collecting data through May 2017. The test model results collected by HHS between May 2016 and May 2017 were summarized in OMB’s report to Congress for legislative action including, but not limited to, consolidating/automating aspects of the federal financial reporting process, simplifying reporting requirements for federal awards, and improving financial transparency. As a result of its efforts, HHS was able to provide OMB with six actionable recommendations based on the areas covered under the Grants portion of this Pilot.

These separately run Pilots culminated in a final report to Congress outlining three overarching recommendations that were based on common themes recognized independently within both the Grants and Contracts pilots. The Report to Congress: DATA Act Pilot Program was submitted to Congress in August of 2017.

Federal Information Technology Acquisition Reform Act

The Federal Information Technology Acquisition Reform Act (FITARA), enacted on December 19, 2014, established an enterprise-wide approach to federal IT investments and provides the CIO of CFO Act agencies with greater authority over IT investments, including authoritative oversight of IT budgets and budget execution, and IT-related personnel practices and decisions.

As part of OMB’s approval of HHS’s FITARA Implementation Plan, one of the four conditions was for HHS to publicly post a revised HHS IT Governance Framework. In the fall of 2016, HHS revised its IT Governance Framework, which establishes the Department’s approach for overseeing and managing IT. The HHS CIO completed all 39 elements and actions from the HHS FITARA Implementation Plan. The HHS CIO issued 10delegations of authority to the HHS OpDiv CIOs, conducted annual reviews of all IT budgets, and reviewed all major IT acquisitions. In addition, the CIO made progress on the Data Center Optimization Initiative Strategic Plan, enhanced transparency and IT risk management processes, and initiated a Department-wide effort focused on software license management. FITARA implementation has strengthened relationships with the OpDivs as well as the CFO, Chief Human Capital Officer, and the Chief Acquisition Officer.

HHS developed a FITARA Dashboard based on legislative metrics, and will further engage the OpDivs in identifying additional metrics to demonstrate HHS’s progress in FITARA. In FY2018, HHS will focus on improving the metrics for CIO authority enhancements, transparency and risk management, portfolio review, data center optimization, and the software license management. For more information on HHS’s progress with implementing FITARA requirements, please visit Digital Strategy at HHS.

Fraud Reduction and Data Analytics Act of 2015

The Department has engaged in various fraud reduction efforts, including activities to meet the requirements under the Fraud Reduction and Data Analytics Act of 2015 (FRDAA), which was enacted in June 2016. In FY 2017, HHS participated with OMB and other agencies in the working group required by FRDAA. As part of this working group, OMB submitted an implementation plan to Congress in May 2017 for an interagency library of data analytics and data sets as required by the law. HHS will also continue working with OMB and other agencies to implement the FRDAA by participating in the OMB-led inter-agency working group.

In addition to the OMB-led efforts to implement the FRDAA, HHS also has other activities underway to meet the intent of the new law. First, in accordance with the law and OMB Circular A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control, HHS’s internal control assessments include the consideration of fraud and financial management risks, as well as the control activities designed to mitigate these risks. Second, HHS is reviewing and updating its financial policies, as needed, which will help to address the law’s requirements. Third, HHS continues to take steps to implement leading practices in fraud risk management, per the Government Accountability Office’s (GAO) Fraud Risk Management Framework and Selected Leading Practices published in July2015. As recommended by GAO, HHS is assessing the federally facilitated exchange’s fraud risk, leveraging GAO’s fraud risk framework to identify and prioritize key areas of potential risk. When this assessment is complete, HHS will apply the lessons learned in assessing this program to fraud risk assessments of other programs.

Federal Managers’ Financial Integrity Act of 1982 and Federal Financial Management Improvement Act of 1996

The Federal Managers’ Financial Integrity Act of 1982 (FMFIA) requires federal agencies to annually evaluate and assert on the effectiveness and efficiency of their internal control and financial management systems. Agency heads must annually provide a statement on whether there is reasonable assurance that the agency’s internal controls are achieving their intended objectives and the agency's financial management systems conform to governmentwide requirements. Section 2 of FMFIA outlines compliance with internal control requirements, while Section 4 dictates conformance with systems requirements. Additionally, agencies must report any identified material weaknesses and provide a plan and schedule for correcting the weaknesses.

In September 2014, GAO released an updated edition of its Standards of Internal Control in the Federal Government, effective FY 2016. The document takes a principles-based approach to internal control, with a balanced focus over operations, reporting, and compliance. In July 2016, OMB released revised Circular A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control. The new Circular complements GAO’s Standards, and it implements requirements of the FMFIA with the intent to improve accountability in federal programs and increase federal agencies’ consideration of Enterprise Risk Management. The Department with its OpDiv and StaffDiv stakeholders are working together to implement the new requirements.

The Federal Financial Management Improvement Act of 1996 (FFMIA) requires federal agency heads to assess the conformance of their financial management information systems to mandated requirements. FFMIA expanded upon FMFIA by requiring that agencies implement and maintain financial management systems that substantially comply with federal financial management systems requirements, applicable federal accounting standards, and the U.S. Standard General Ledger at the transaction level. Guidance for determining compliance with FFMIA is provided in OMB Circular A-123, Appendix D, Compliance with the FFMIA of 1996.

HHS is fully focused on the requirements of FMFIA and FFMIA through its internal control program and a Department-wide approach to risk management. Based on thorough ongoing internal assessments and FY 2017 audit findings, HHS provides reasonable assurance that controls are operating effectively. For further information, see the “Management Assurances” section. We are actively engaged with our OpDivs to correct the identified material weaknesses through a corrective action process focused on addressing the true root cause of deficiencies, and supported by active management oversight. More information on the Department’s internal control efforts and the HHS Statement of Assurance follows.

Internal Control

FMFIA requires agency heads to annually evaluate and report on the internal control and financial systems that protect the integrity of federal programs. This evaluation aims to provide reasonable assurance that internal controls are achieving the objectives of effective and efficient operations, reliable financial reporting, and compliance with applicable laws and regulations. The safeguarding of assets is a subset of these objectives. HHS performs rigorous, risk-based evaluations of its internal controls in compliance with OMB Circular A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control.

HHS management is directly responsible for establishing and maintaining effective internal controls in their respective areas of responsibility. As part of this responsibility, management regularly evaluates internal control and HHS executive leadership provides annual assurance statements reporting on the effectiveness of controls at meeting objectives. The HHS Risk Management and Financial Oversight Board evaluates the OpDivs’ management assurances and recommends a Department assurance for the Secretary’s consideration and approval, resulting in the Secretary’s annual Statement of Assurance.

HHS aims to strengthen its internal control assessment and reporting process to more effectively identify key risks, develop effective risk responses, and implement timely corrective actions. The HHS FY 2017 OMB Circular A-123 assessment recognizes one material noncompliance with IPIA regarding Error Rate Measurement and one material noncompliance with the Social Security Act related to the Medicare appeals process. Beginning in FY 2015, HHS implemented a comprehensive strategy to strengthen the HHS Financial Systems Controls Environment and address the IT material weakness. Since then, significant progress has been made in resolving audit findings, reducing risk across the operating environment, and maturing the security and controls posture of HHS’s financial systems. As part of the strategy, HHS established a Management Assessment Framework that defines the conditions and criteria to evaluate the severity of control deficiencies found in Information System Controls and Security in HHS’s financial systems. Evaluation criteria include four key components: (1) Leadership Commitment and Sustained Governance; (2) Reduced Risk through Corrective Actions; (3) Demonstrated Measurable Remediation Progress; and (4) Mature Controls Environment. While control deficiencies still exist across several HHS FISCAM systems, our evaluation based on the HHS Management Assessment Framework demonstrates that these deficiencies, in aggregate, no longer rise to the level of a “material weakness” under OMB Circular A-123, as of September 30, 2017.

Maintaining integrity and accountability in all programs and operations is critical to HHS’s mission and demonstrates responsible stewardship over assets and resources. It also promotes responsible leadership, ensures the effective delivery of high quality services to the American people, and maximizes desired program outcomes.

MANAGEMENT ASSURANCES

Statement of Assurance

The Department of Health and Human Services’ (HHS or the Department) management is responsible for managing risks and maintaining effective internal control to meet the objectives of Sections 2 and 4 of the Federal Managers’ Financial Integrity Act of 1982 (FMFIA). These objectives are to ensure (1) effective and efficient operations; (2)reliable financial reporting; and (3) compliance with applicable laws and regulations. The safeguarding of assets is a subset of these objectives.

HHS conducted its assessment of risk and internal control in accordance with OMB Circular A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control. Based on the results of the assessment, the Department provides reasonable assurance that internal controls over operations, reporting, and compliance were operating effectively as of September 30, 2017, with the exception of two material noncompliances: one involving noncompliance with the Improper Payments Information Act (IPIA) related to Error Rate Measurement, and the second involving noncompliance with the Social Security Act related to the Medicare appeals process.

HHS is taking steps to address the material noncompliance related to the Medicare appeals process, as described in the “Corrective Action Plans for Material Weaknesses” section. Remediation for the material noncompliance related to Error Rate Measurement relies on a modification to legislation to require states to participate in an improper payment rate measurement.

The Federal Financial Management Improvement Act of 1996 (FFMIA) requires agencies to implement and maintain financial management systems that substantially comply with federal financial management system requirements, federal accounting standards, and the United States Standard General Ledger (USSGL) at the transaction level. HHS conducted its evaluation of financial management systems for compliance with FFMIA in accordance with OMB Circular A-123, Appendix D. Based on the results of this assessment, HHS provides reasonable assurance that its overall financial management systems substantially comply with the FFMIA and substantially conform to the objectives of FMFIA, Section 4.

HHS will continue to ensure accountability and transparency over the management of taxpayer dollars, and strive for the continuing progress and enhancement of its internal control and financial management programs.

/Eric D. Hargan/

Eric D. Hargan

Acting Secretary

November 14, 2017

Summary of Material Weaknesses

- Error Rate Measurement

HHS reports a statutory limitation relating to the Temporary Assistance for Needy Families (TANF) program that results in a material noncompliance with IPIA. The TANF program is not reporting an error rate for FY 2017, as required by IPIA, because statutory limitations currently preclude HHS from requiring states to provide information needed for determining a TANF improper payment measurement.

- Medicare Appeals Process

Several factors, including the growth in Medicare claims and HHS’s continued investment and focus on ensuring program integrity, have led to more appeals than Levels 3 and 4 of the Medicare appeals process can adjudicate within the timeframes required by the Social Security Act.

From FY 2010 through FY 2016 (most recent complete year data available), the HHS Office of Medicare Hearings and Appeals (OMHA) experienced an overall 315 percent increase in the number of Level 3 appeals received annually. During the same timeframe, the HHS Departmental Appeals Board (DAB) experienced an overall 405percent increase in the number of Level 4 appeals it received annually. However, while the volume of appeals has increased dramatically, funding has remained comparatively stagnant for the relevant OMHA and DAB operations. As a result, at the end of FY 2017, approximately 532,000 appeals were waiting to be adjudicated by OMHA and over 29,000 appeals were waiting to be reviewed at the DAB Medicare Appeals Council. This has led to the inability to meet statutory decisional timeframes of 90 days at Levels 3 and 4 of the Medicare appeals process.

Corrective Action Plans for Material Weaknesses

- Error Rate Measurement